At least $110,000 Lost to Variant of Loan Scam

ScamAlert Advisor | 14 Oct 2019

The Police and Ministry of Law’s Registry of Moneylenders (“ROM”) would like to alert the public on the emergence of a new variant of loan scam whereby victims were instructed by the perpetrators to make payment after they responded to unsolicited text messages offering loans. Since September 2019, the Police have received more than 20 of such reports, with at least $110,000 cheated.

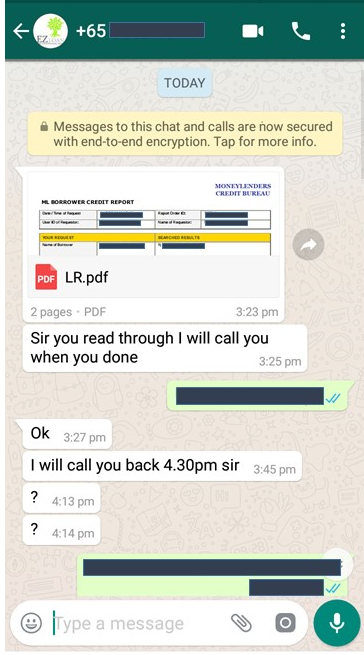

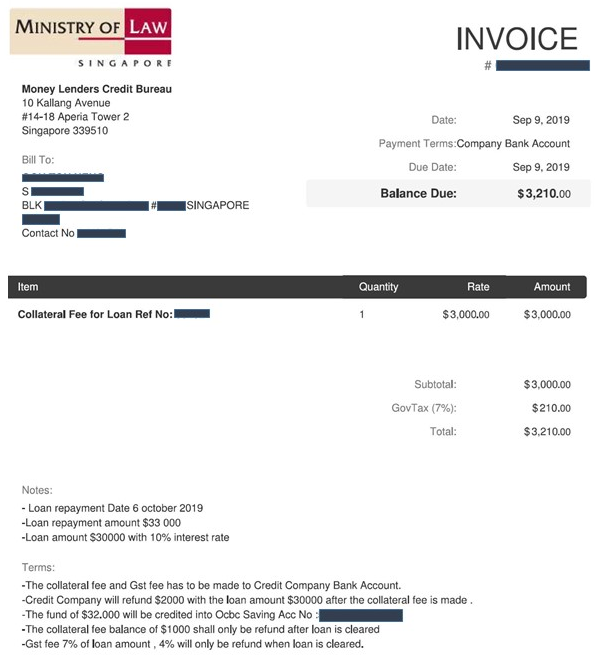

Once the victims responded to the text messages, the perpetrators would typically send victims PDF documents, purportedly from the Ministry of Law and/or Monetary Authority of Singapore, informing them that they are required to pay a deposit sum and 7% GST for the loan amount, before the loan can be approved. The intent is to deceive the victims into believing that they are corresponding with a licensed moneylender.

In some cases, the victims received another PDF document informing that the loan request had been processed. When these victims declined to make the payments, the perpetrators would harass them by claiming that the loans have already been approved and that they had to pay a processing fee to cancel the loans.

Members of the public are reminded of the following:

- A licensed moneylender (“LML”) is not allowed to make any cold calls or send any unsolicited text messages to members of the public.

- A LML cannot approve or grant a loan to a borrower without having the borrower first turn up physically at the LML’s approved place of business. The LML is obliged under law to verify the identity and particulars of the borrower at such an office. The address of each licensed moneylending office is published on the list of licensed moneylenders on ROM’s website at https://www.mlaw.gov.sg/content/rom/en/information-for-borrowers/list-of-licensed-moneylenders-in-singapore.html.

- A LML will not ask a loan applicant to make any payment before the disbursement of the loan, or to make any payment to secure the disbursement of the loan. This includes GST, “admin fee”, “processing fee”, or any other fees. An administrative fee may be charged by the LML after the loan has been granted, but this will usually be deducted from the loan principal that is disbursed to the borrower.

Members of the public are also advised to take the following precautions with regard to such scams:

- Ignore such advertisements. Do not reply to these messages. Instead, block or report the number as spam on WhatsApp or through third party applications.

- Do not give out your personal information such as NRIC, SingPass or bank account details to anyone.

If you wish to provide any information related to such scams, please call the Police hotline at 1800-255-0000, or submit it online at www.police.gov.sg/iwitness. If you require urgent Police assistance, please dial ‘999’. The public can call the X-Ah Long hotline at 1800-924-5664 if they suspect or know of anyone who could be involved in illegal loansharking activities.

Join the ‘Let's Fight Scams’ campaign by signing up as our advocate! Advocates will receive the latest scam info via WhatsApp which they can share with their family and friends.

Together, we can help stop scams and prevent our loved ones from becoming the next victim of scam!

To join, simply scan the following QR code or click on this link http://bit.ly/letsfightscamsNCPC!